Commercial Energy Prices – It’s time to stop the Creep!

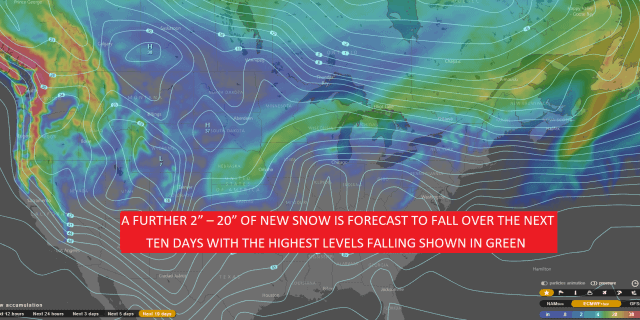

Commercial energy prices have been rising, with more snow on its way over the next few days. Several states continue to deal with “severe” winter weather and the impact on prices from supply and demand. Natural gas spot prices have remained steady, even though this winter has seen more natural gas withdrawn from storage than at any other time in history. Interestingly, after last Friday’s storage report showed weekly withdrawals less than expected, spot prices ticked down a little.

So, if you are wondering what on earth we are talking about, we are referring to price Creep. Week by week, month by month over the last two years, commercial energy prices of natural gas and electricity have been steadily rising, to the point where spot prices are double today what they were two years ago. It’s clear US energy price drivers are changing, something that has been happening since the invention of the gas lamp, and this upward trend is likely to continue for quite some time, so what’s going on and what can you do about it?

Ten years ago, the massive natural gas shale revolution, combined with recessionary demand destruction, brought energy prices crashing down. Commercial and Industrial energy consumers have now become so accustomed to low energy prices, few appear worried by these recent rises. It’s a bit like your favorite penny chew becoming two pennies – who cares?

Commercial Energy Prices – Setting Your Strategy

Generation – US natural gas demand continues to grow most visibly in electricity generation at the expense of coal. Natural gas is already 33% of the US total compared to coal 30%, something the EIA predicts will be 34% and 28% respectively by 2019. This increase makes natural gas an essential factor in the marginal electricity price in many areas.

Exports – Natural gas exports are on the rise too. Sabine Pass, located on the US Gulf Coast near the Louisiana-Texas border, consists of four existing natural gas liquefaction units, with a fifth currently under construction. When complete, Sabine Pass will have a total liquefaction capacity of 3.5 Bcf/d. Five additional LNG projects are now under construction in the United States and expected to increase total US liquefaction capacity to 9.6 Bcf/d by the end of 2019. That is almost half of the daily natural gas output of the Marcellus shale region.

Demand – Energy demand grows as our economy recovers, and also playing its part, but not to the same extent. Because we use energy more efficiently today, any significant uptick in demand has so far been curbed. However, any large-scale swings in usage, electric vehicles, for example, and we may well see this impact prices too.

As with any commodity, uncertainties in supply and demand drive volatility. Commercial and Industrial energy consumers have to manage this uncertain cost in their supply chain. Most will tend to simply fix their energy costs through one or two-year fixed-price supply agreements. It’s a strategy that secures cost for a set period but leaves them exposed to price hikes at contract end or worse competitive risk if prices fall after they have fixed. In short, the tools they receive are very blunt instruments operating in an exact environment.

To address near-term volatility and the effects of longer-term price creep, Vervantis developed a unique energy contracting process that ensures consumer positions and actively managing the price risk associated with them.

Using proprietary risk valuation models and supply agreements, energy prices are monitored daily and fixed and unfixed as required (on average, 2 or 3 transactions a month) to deliver consumers a smoother, less risky path to achieving their strategy.

During periods of volatility, consumers using this process took ten times less market risk, participated in the market opportunity they would otherwise have missed, and enjoyed several years of competitive advantage. The best performers started their process while prices were low, making price creep the worry of their competitors.

Contact us for more information.